Top Three Most Successful Forex Traders EVER

Top Three Most Successful Forex Traders EVER

The best time to start investing is today.

There is no upside in taking on that fight, so I no longer publish stats [the exception is my paid investment newsletter (not day trading) which is up 39% YTD, plus a 5.75% dividend yield]. Even if you decided it was possible, you would still need to put in the thousands of hours it takes to reach the level discussed in the article. The people who work their asses off get there, and the other 96% don’t. But this comes at the cost of them taking some your profit (or getting a return some other way)…at the beginning this cost is typically offset by access to more capital and reduced trading fees.

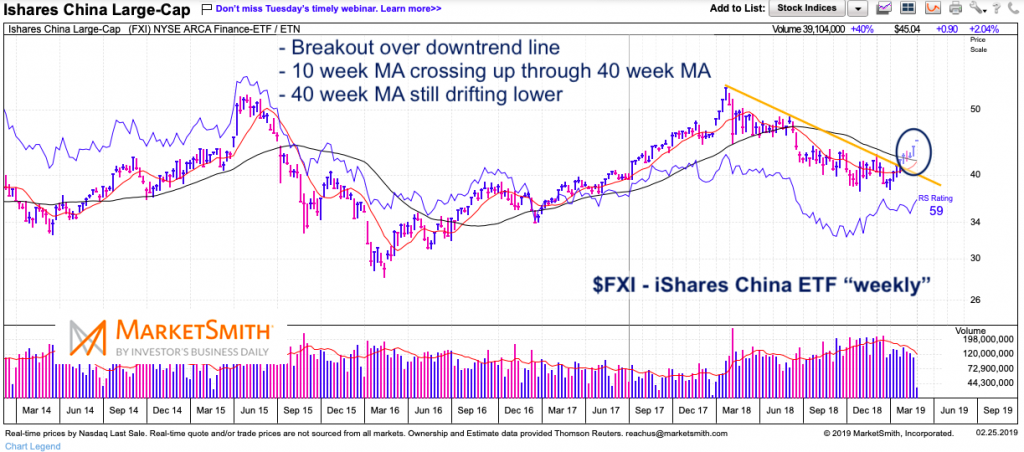

Exchange Traded Funds

This helps filter out the trades where the price shoots up a $1, pulls back $0.10, consolidates, then drops another $0.10, consolidates, drops again, and so on. Weak moves (like a pullback that seems very hesitant) or a chart pattern forming (like a triangle) may cause me to jump in a bit earlier instead of waiting for the 40% to 70% retracement. Whether your day trading involves homework and research depends on which stock picking method you choose (see above).

Basically, you are just waiting for a pullback moving against the strong move. “You cannot deduct losses from sales or trades of stock or securities in a wash sale unless the loss was incurred in the ordinary course of your business as a dealer in stock or securities. Turning what was originally a short term trade into holding a large position overnight on events/news.

Day trading involves buying and selling positions quickly, with attempts to make small profits by trading large volume from the multiple trades. The ETFs suitable for day trading should have high levels ofliquidityenabling easy execution of the trades at fair prices.

Here’s where knowing a little bit more about technical analysis helps. As a guideline, I’m looking for the pullback to retrace about 40% to 70% of the initial wave after the open. For example, if the price spikes $1 after the open, I will only consider a consolidation a potential trading opportunity if it occurs $0.40 to $0.70 below the high that was just set.

Can you suggest an FOREX ECN Broker here in the USA? I live in California and wish to benefit from the lower commissions, just as you do with your trading.

As they say, "Plan the trade and trade the plan." Success is impossible without discipline. Day trading is not for everyone and involves significant risks. Moreover, it requires an in-depth understanding of how the markets work and various strategies for profiting in the short term.

Note that you can’t perpetually compound your account at these returns. Most day traders trade with a set amount of capital and withdraw all profits over and above that amount each month.

Day trading could be a stressful job for inexperienced traders. This is why some people decide to try day trading with small amounts first.

- Professional traders like David Green recommend not risking more than 1% per trade based on the size of your portfolio.

- How much time you put into your trading education.

- Margin based leverage allows one to take a higher exposure with low trading capital.

- It often takes five months or more of solid practice every day and on weekends before you can open a live account and expect to make a consistent income off only trading for a couple of hours a day.

So right now, it’s more like 1 to 3 trades per day (assuming only trading during the most volatile 3 or 4 hours of the day). Back in 2009 when pairs where moving 400 or 500 pips some days potential was higher than what I have laid out here. When a pair is moving 150 pips a day there is theoretically twice the potential as when it is moving 75 pips per day (currently, we are more toward the latter case). We can’t force money out of the market, we can only take what it provides…sometimes that is more and other times less.

It's understandable if your first thought was to start by taking your $100 and buying small amounts of stock. After all, there's a lot of compelling evidence that investing in stocks is the best way for regular people to attain financial independence. But a lot of people don't understand how important it is to also have a strong margin of safety with their finances.

We’re going to highlight the benefits of adding ETFs in your trading and investing portfolio. However, we’re also going to shed some light on the risk involved with ETF (exchange-traded funds). Typically, these funds are called "2X," "3X" or "Ultra" funds. As the names imply, the goal of these funds is to generate some multiple of an index's returns each day.

Turning down an opportunity to go to Harvard Business School, Tudor Jones went on to work as a commodities trader in the NYSE. He established his own firm, Tudor Investment Corporation.

I personally prefer the forex market, but futures and stocks are also great. I wish I would have engaged some good mentors early on. Most of my trading knowledge was built by observing and reading about every good trader I could find. Then, after about 6 years (I was with a full-time job), I implemented a strategy to generate consistent income from equities (80% winning days). Almost doubled my money until I got burnt out and lost control of my emotions.

It’s regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit. Webull is widely considered one of the best Robinhood alternatives. In other words, day traders who try and make a career out of it are betting their life savings that they will be the 1 out of 100 who can make a living doing it.

This page will look at the benefits of day trading for a living, what and where people are trading, plus offer you some invaluable tips. Check your trading account balance so you know exactly how much you can risk on each trade. Risking 2% or less of your account balance is recommended, 1% if you are new and don't have at least several months of profitable trading under your belt. Depending on your time zone, day trading may be a very early endeavor or allow you to sleep in. You can choose from one of their pre-made diversified portfolios or customize your own by purchasing stocks and ETFs through their platform.

Is it possible to have an experienced day trader create a platform, to simply trade with someone else’s money, and that someone pays a percentage of profit. If we sell all our positions that day, our buying power will reset to 120K the next day however, we should not be able to sell any additional positions until the T+3 settlement rule kicks in. So, instead of having 20 trading days, we would only have about 6 trading days for a total of 30 actual trades (6 x 5 trades a day). Some forex brokers do provide level 2 data (I have it, but don’t use it normally). But it is not the same as the stock or futures market.

Although, remember, that with many CFDs, the broker is on the other side of the transaction much of the time. If you keep hammering them with huge volume and winning, they won’t allow you to keep doing it.

If you are trading the higher volume stocks on the list then a market order should be fine….most of the time. In other words do you use a margin account or cash account? I didnt find anything explaining the brokerage account setup in this article.

Комментарии

Отправить комментарий